Get Bespoke Advice on Company Liquidations

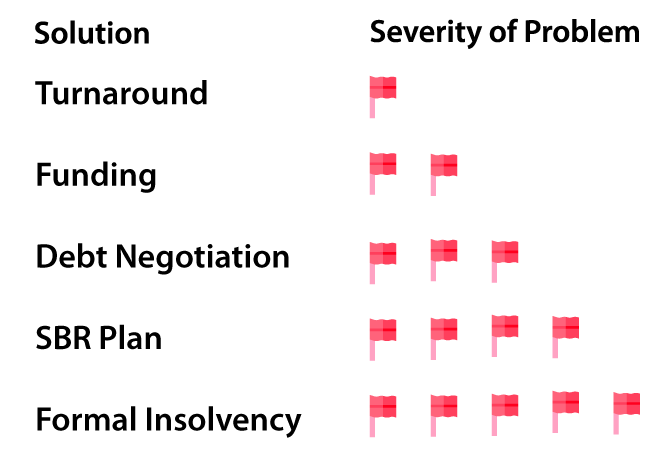

It could be that your tax debt has ballooned and you don't know why. Maybe your creditors are harassing you and you need help negotiating with them. Perhaps you've decided to stop the losses but you don't know how. Insolvency is a very real thing that thousands of business owners deal with every day. We've got the best advisors for how to deal with it.

We've put together a simple explanation of how it all works. If you'd like to learn more, please book a call or call us on 02 9188 0815

• Which liquidator should I choose?

• How do I deal with a statutory demand?

• How much does the process cost?

• Can I keep the business?

• Is my family home at risk?

To get a better understanding of your options, book a free consultation with a MyDebtRelief expert.

BEFORE YOU SIGN ON THE DOTTED LINE

Formal insolvency is a complicated and very niche part of the business world. Accountants and lawyers require specialised training to work within the insolvency industry. For this reason, the absolute best thing you can do for yourself and your business is to have a brief chat with a specialist before you sign up to any plan.

Knowing where the most common mistakes are can be the difference between a quick and easy exit and a long, painful, expensive liquidation. Arm yourself with some insider secrets and book a call today.

Case Study

Richard ran a company that requires a special licence. Due to a workplace incident, Richard had to close his doors for a month. During this time his revenue stopped but his expenses grew by $120,000.

Richard was now threatened with legal demands. Because his business was still viable, he chose to try to save the business using a voluntary administration costing approximately $25,000. Creditors were paid a portion of their debt and he was able to return to trading within six weeks.

Free Consultation

Schedule a free consultation over the phone or Zoom. We'll go over some basic questions over your situation and can give some very general advice.

Expert Panel Referral

We introduce you to a member of our expert panel who specialises in your particular situation and questions. The expert presents you with a couple of options to choose from as to how you'd like to proceed.

Review Your Options

After you weigh up what your potential outcomes are, you can pick your optimal outcome.

You can even opt out of the process at this point at no charge.

Execution of

the Plan

The expert works with you to execute the plan and help you reach where you'd like to be.